State of Manufacturing®

The State of Manufacturing® is an annual survey of Minnesota’s manufacturing industry, highlighting the trends, conditions, and outlook of executives from around the state.

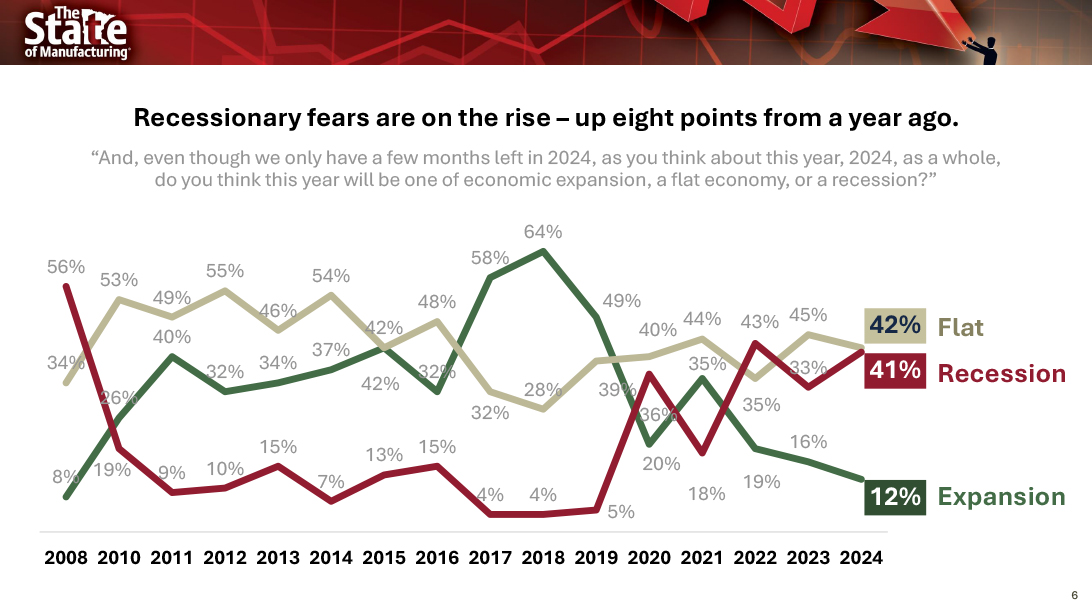

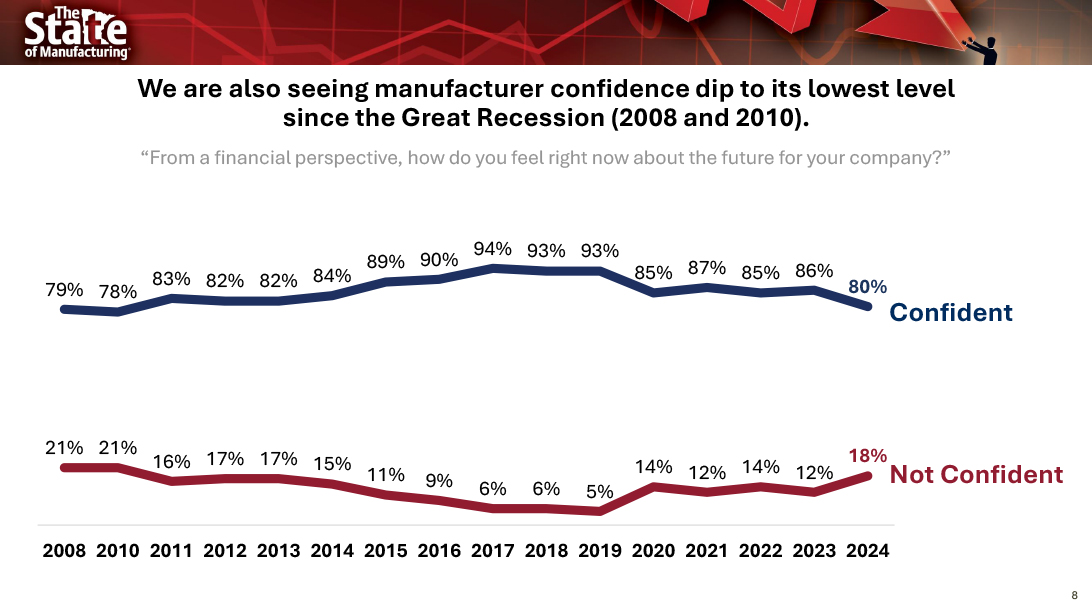

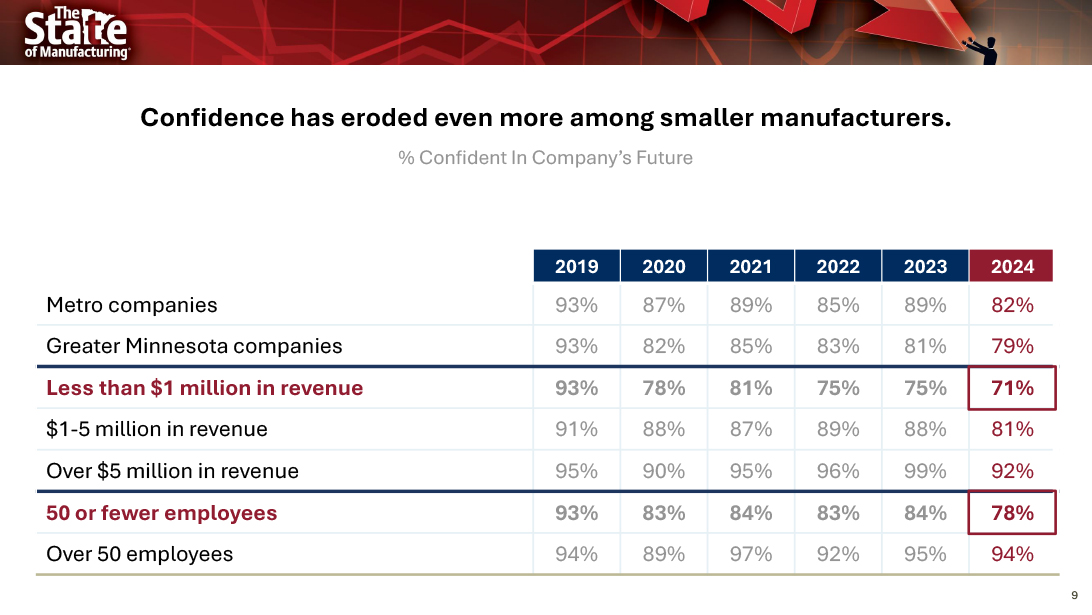

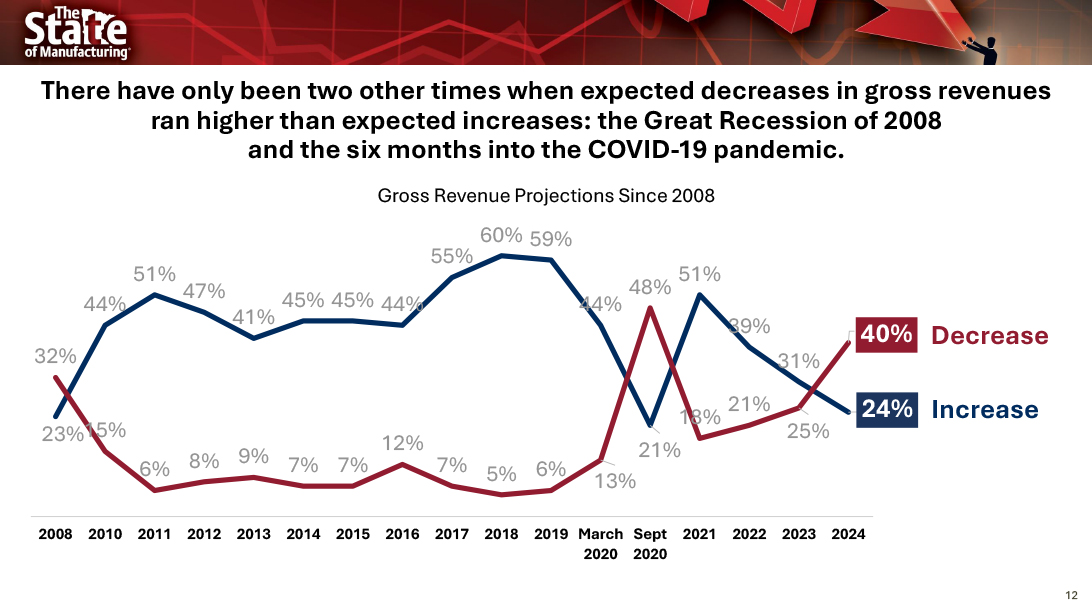

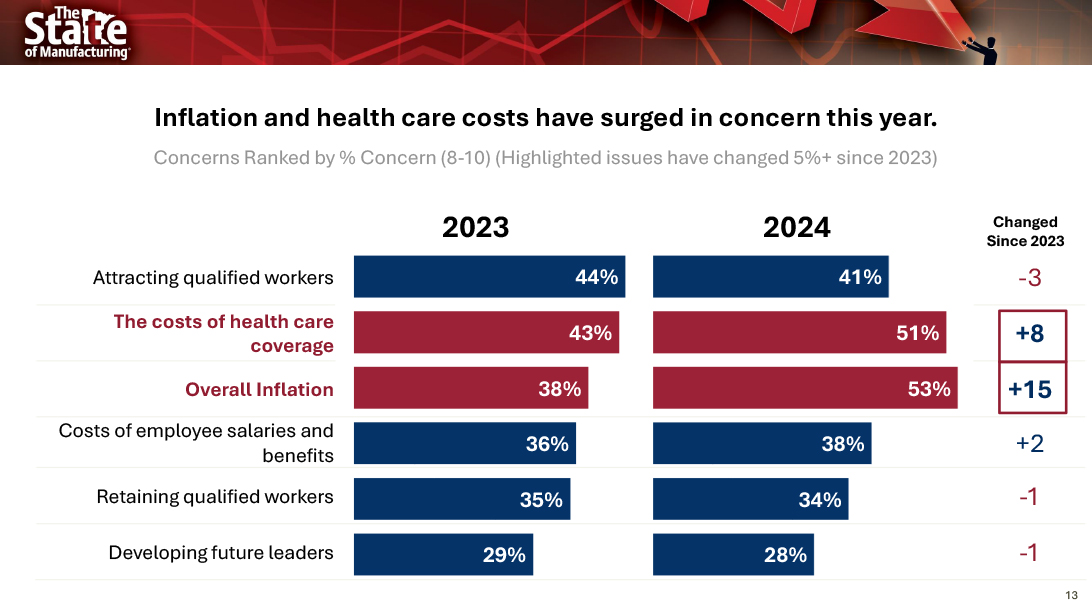

Dread: Manufacturers express unprecedented anxiety about the economy

The State of Manufacturing® is the annual survey of Minnesota manufacturing executives that reveals the latest trends in key business areas including growth, workforce, supply chain, economic confidence, and more. Each year, over 535 manufacturing executives are surveyed, representing a broad mix of manufacturers by region, employee count and annual revenue.

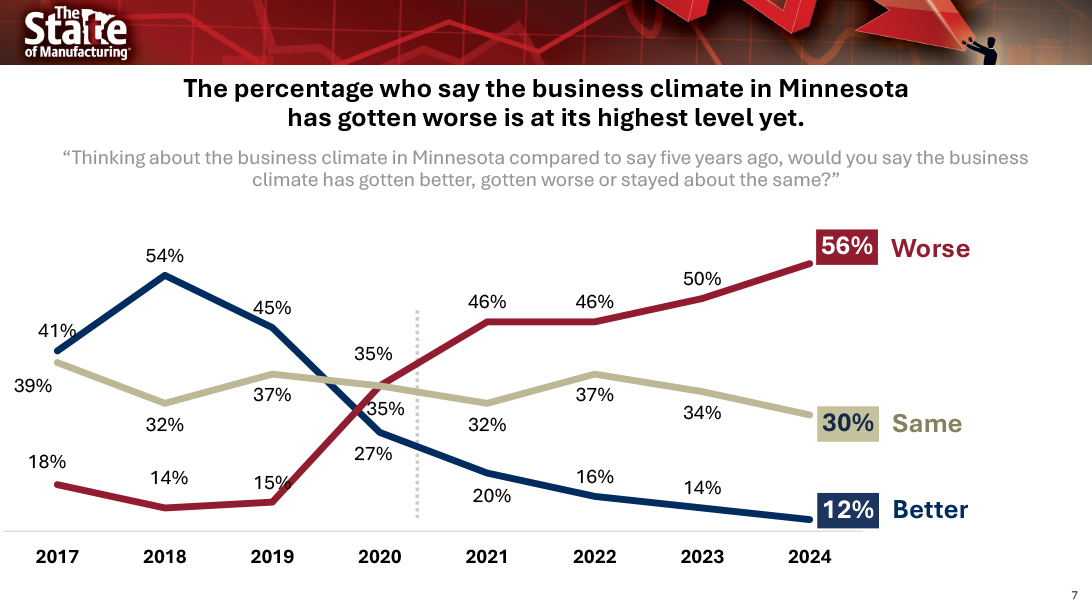

This year, our survey shows a growing percentage of manufacturers who believe that the Minnesota business climate is worse than before. In 2024, a record-high 56% of respondents note that it’s worse, up from 50% last year and 15% five years ago. This year, 30% believe the business climate has held steady and 12% think it’s better — a decline from 2021 when 20% thought it was better.

Manufacturers express unprecedented anxiety about the economy amid the burden of new legislative mandates.

View complete PDF slide deck of 2024 State of Manufacturing® data here.

Each year, Enterprise Minnesota reveals the findings of our results in Minneapolis, then holds regional events around the state to take the conversation on the road to local communities. Subscribe to stay informed on upcoming news and local events.

Stay informed: Subscribe to Enterprise Minnesota to stay informed of local events happening in your region – Subscribe

Requests for interview

Bob Kill, president & CEO of Enterprise Minnesota is available for comment and interview regarding the State of Manufacturing® survey. If you would like to schedule an interview, please contact Robert Lodge ([email protected]).

The State of Manufacturing survey is made possible through the support of our generous partners. If you are interested in being a part of the State of Manufacturing survey, please contact us.

The State of Manufacturing survey is conducted by Meeting Street Insights and is underwritten by Enterprise Minnesota.

Research & Data

Since 2008, the State of Manufacturing® survey has been providing industry-leading insight and analysis to business leaders, public policy makers, educators, and the media.