Formerly a bullish group, manufacturers are feeling downright pessimistic about prospects for their industry and the health of Minnesota’s business climate. Their fears about inflation, recession, and the economy have merged and metastasized into record low levels of confidence in their ability to succeed in the state.

An alarming trend line in the past four years has been a growing percentage of manufacturers who believe that the Minnesota business climate is worse than before. In this year’s State of Manufacturing® (SOM) survey, a record-high 56% of respondents note that it’s worse, up from 50% last year and 15% five years ago. This year, 30% believe the business climate has held steady and 12% think it’s better — a decline from 2021 when 20% thought it was better.

“The last time we saw numbers like this the economy was falling off a cliff. This is the highest percentage of people who feel that the business climate of Minnesota is worse since the Great Recession in 2008,” says Bob Kill, president and CEO of Enterprise Minnesota. “When manufacturers see revenue down and profitability down, then capital expenditures trend down. That means they don’t have confidence, so they won’t invest long term. They will invest less in technology and invest less in people.”

Now in its 16th year, the SOM survey has steadily gauged the health of Minnesota’s manufacturing industry. The tenor of manufacturers’ mood this year is one of worry paired with concerns about the economy and their own business prospects. Pollster Rob Autry, whose research company Meeting Street Insights has conducted the survey since its start in 2008, noticed a stark shift in manufacturers’ outlook this year.

“The big things that stand out to me are growing anxiety and worry about the economy, inflation, and the financial pressure that many of thetse manufacturers are now feeling. I think that’s noticeably different than what we saw a year ago,” says Autry.

Every year the pollster surveys more than 400 manufacturing executives statewide, in addition to an oversampling of 50 executives in each of the six McKnight Initiative Foundation regions. Respondents represent a broad mix of manufacturers by region, employee count, and annual revenue. The SOM survey uncovers the latest trends in key business areas including growth, workforce, supply chain, economic confidence, and more.

A random sample of Minnesota manufacturing executives participate in the telephone survey, including owners, CEOs, CFOs, COOs, presidents, vice presidents, and managing officers. The survey has a margin of error of ±4.9%. In addition, Enterprise Minnesota pairs its polling data with focus groups held in the fall to gain deeper understanding from manufacturing leaders. Combined, these efforts provide a macro view and rich insight into the state’s economic engine.

Waning confidence

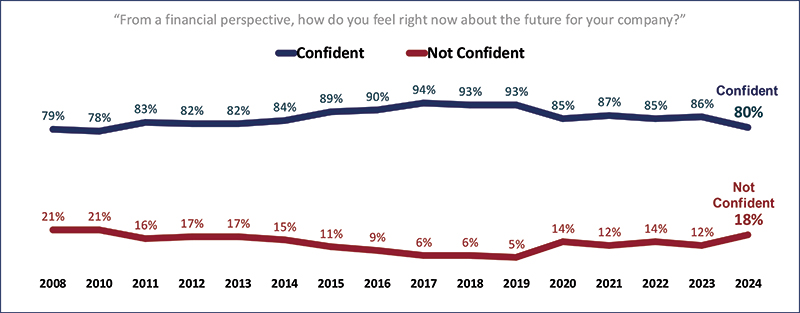

The 2024 SOM survey found that manufacturers’ confidence in their own companies landed at 80% — a number that typically sat in the high 80s and low 90s in past surveys. Confidence held steady even during the depths of the COVID-19 pandemic. The only time this metric was worse occurred during the Great Recession period of 2008-2010, when it hovered around 78-79%.

Kill believes that the crashing confidence stems from legislative changes enacted in 2023, which started rolling out this year and will continue into January 2026. Minnesota manufacturers big and small are starting to feel the financial hit from newly required programs like earned sick and safe time and paid family and medical leave.

“The takeaway message for me from the survey is that the people our legislature thought they were helping are hurting the most,” Kill says. “The inflation of wages and inflation of benefits are things they have to live with. Manufacturers are usually optimistic, despite the challenges, when they can deal with the problem. But when they are forced to pay for these new mandates, the reality of remaining employers of great jobs starts to wane because it’s more difficult for many small manufacturing companies to remain in business.”

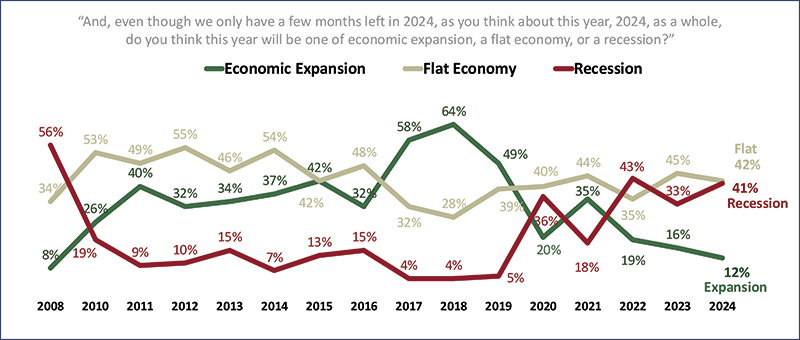

To make matters worse, a strong fear of recession has intensified among Minnesota manufacturers. When asked whether they believe 2024 will be a year of economic expansion, a flat economy, or a recession, 41% believe there will be a recession — an eight-point increase from last year. Autry notes that in his tenure conducting the SOM survey, fears of recession topped 40% only two other times: during the Great Recession in 2008 and in 2022, when the economy was struggling to recover from the pandemic and inflation was spiking.

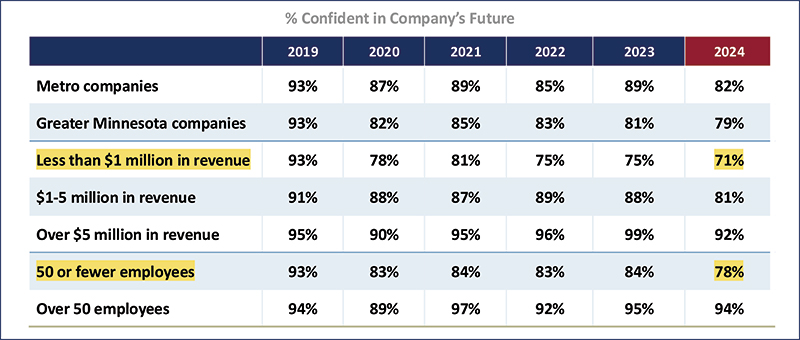

Small manufacturers are feeling especially shaken by their prospects, showing an erosion in confidence from last year.

Another contingent of manufacturers aren’t particularly optimistic either, with 42% expecting the economy to stay flat. Only 12% envision an expanding economy, a drop of four points from last year. “I think manufacturers really do feel that the economy is in a bad place,” Autry says. “On top of the real fear that we’re heading into a recession, there is the expansion number. The percentage of manufacturers who believe it will be a year of economic expansion has never been lower than the first survey we did in December 2008, when it was 8%.”

Small manufacturers are feeling especially shaken by their prospects, showing an erosion in confidence from last year. This year, those with less than $1 million in revenues had decreasing confidence in their companies’ future, dropping to 71% from 75% last year. This segment makes up nearly two-thirds of the state’s manufacturing sector, Kill says. In addition, manufacturers with less than 50 employees also had falling confidence, decreasing to 78% this year compared to 84% in 2023. Comparatively, larger companies stayed relatively confident — 94% in 2024 and 95% last year.

Low confidence in action

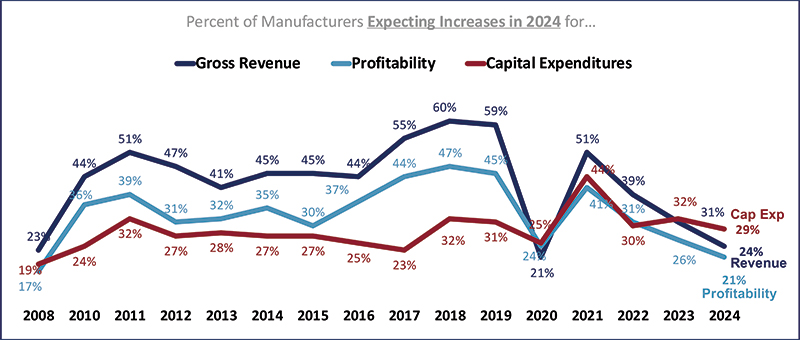

The sour outlook about the state’s economy and business climate is having a real impact on how manufacturers operate their companies. When asked about projections for 2024, just 24% expect an increase in revenue, while 21% expect an increase in profitability. Both metrics are down five points from 2023.

Autry points to another concerning survey result. The number of manufacturers bracing for decreases in gross revenues and profitability is significantly bigger this year compared to 2023. In 2024, 41% expect a decrease in profitability, up from 26% who predicted a decline last year. Similarly, 40% now foresee a drop in gross revenue, compared to 25% who anticipated a decline in 2023.

With this sharp increase in companies staring down decreases in revenues and profitability, it’s not surprising to Kill that only 29% intend to increase their capital expenditures. “Manufacturers have less confidence overall in the state of Minnesota as a friendly place for business,” he adds.

“In the second quarter, Minnesota GDP growth was 1.8% and the average nationally was over 3%. The only lower states were Alaska and North Dakota,” Kill says. “That lack of confidence means that they will invest less in technology and invest less in people, which means that companies will not be growing.”

Barriers to success

When thinking about their biggest impediments to growth, inflation (33%), rising costs of materials (30%), and attracting and retaining a qualified workforce (27%) topped manufacturers’ list. The most dramatic change comes in a different category: respondents cite an unfavorable business climate as their biggest obstacle to growth. This concern increased to 21% from 14% in 2023.

A perennial challenge for manufacturers — attracting and retaining a qualified workforce — eased up this year, dropping to 27% compared to 39% in 2023. However, that change shouldn’t be taken as good news. “If manufacturers are not growing or confident, they’re not hiring,” Kill says. “The cost of salaries are up, inflation is up, health care is up. That puts wind in their face, and they are not going to grow and add workers.”

In fact, opportunities for job seekers in manufacturing have declined. This year, 58% of manufacturers report having no open positions, a decrease from 55% in 2023. Just 42% of manufacturers are hiring, the lowest number recorded in survey history, Autry adds.

Small companies with fewer than 50 employees have seen a big drop in hiring. This year, 32% are hiring, a decrease of 23 points since 2021 when 55% of manufacturers were onboarding new hires. And despite having fewer positions to fill, manufacturers still find it challenging to find qualified candidates. Overall, 79% find it very difficult or somewhat difficult to attract qualified candidates.

Heartburn issues

Inflation and rising health care costs have put immense pressure on manufacturers. When asked about their biggest concerns, overall inflation came in first at 53%, up from 38% last year. The increasing cost of health care ranked second, jumping eight points from 2023 to land at 51%. Attracting and retaining a qualified workforce was third at 41%, a one-year decline from 44% last year.

Survey data certainly demonstrates the impact of inflation on manufacturers, Autry says, and SOM focus groups especially underscored those headaches. “We heard that inflation is part of their larger concerns about the economy, but they are also concerned about expenses. That’s not just impacting them, it’s impacting their customers,” he adds. “Their customers feel like they can’t invest money in parts or the products manufacturers are manufacturing, and that impacts revenue and profitability.”

Also weighing on manufacturers’ minds are recent legislative changes that started hitting their bottom lines this year, including earned sick and safe time policies. In January 2026, Minnesota’s new paid family and medical leave law will go into effect. Manufacturers are anticipating negative financial impacts from these new programs, with 68% expecting a major or minor effect from the payroll tax required to fund the paid family and medical leave program.

In addition, 67% anticipate major or minor effects from the earned sick and safe time requirements. Another big sticking point: 65% see major or minor impacts on small businesses needing to contribute to employees’ paid leave at the same rate as larger corporations. Overall, these legislative changes make Minnesota a less attractive place to do business, according to 65% of respondents. Of that group, 45% believe it is much less attractive.

Regional differences

Views about top concerns varied sharply across the state, illustrated by the McKnight Initiative Foundation regions. Though five of the six regions shared the top concerns of inflation and rising health care costs, worries about overall inflation were amplified in Greater Minnesota. Northwest Minnesota saw the highest number at 80%, followed by 67% in Central Minnesota. In Northeast Minnesota, inflation was the third biggest concern at 44%.

The Northeast’s chief concern is the cost of health care at 47%, while worries about these costs were even greater in other regions. In Central Minnesota, health care concerns ranked second at 62% and 58% in Southwest Minnesota. Twin Cities manufacturers cite inflation as their biggest concern at 60%, while costs of health care landed second at 56%.

Regardless of region, there are storm clouds over manufacturers and a pervasive sentiment that Minnesota is headed in the wrong direction. “Manufacturers have real concerns about the broader economy and the business climate in the state,” Autry says. “They are more pessimistic about how their own company is performing, and they have real concerns about the actions taken by the legislature and governor last year and the impacts on their business. There is a lot more anxiety bubbling up and a lot more negativity than we’ve seen in the past.”

Return to the Winter 2024 issue of Enterprise Minnesota® magazine.